Price Action Still Leads but Only Just

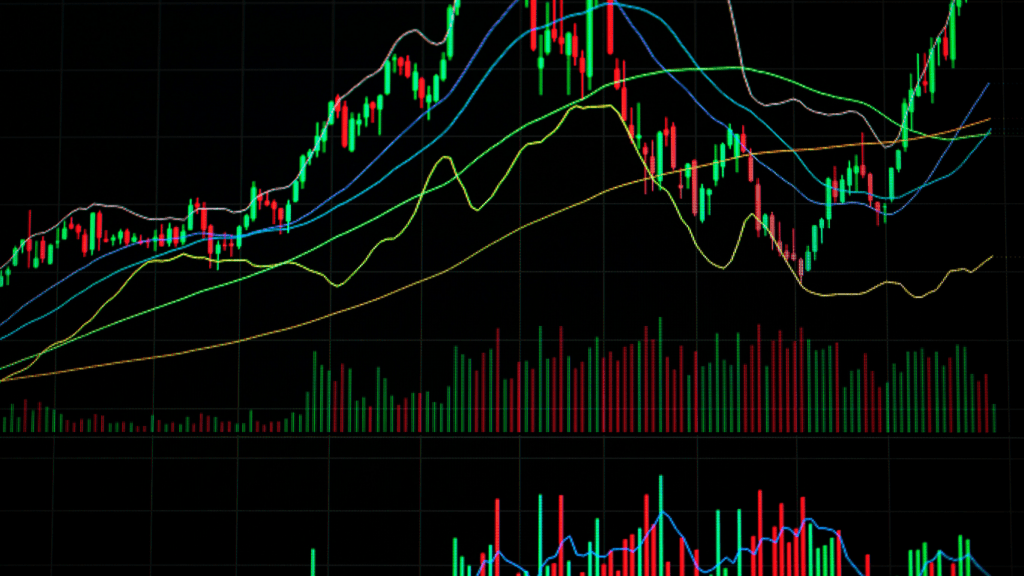

Even with AI powered models, on chain tools, and endless sentiment trackers, price action still sits at the top of the crypto analysis food chain. Candlestick patterns, volume spikes, and support and resistance levels are the backbone of technical strategy for a reason they show what’s actually happening, not just what might happen. Traders still react first to the chart. When Bitcoin prints a doji on high volume near a long term level, people pay attention.

But in 2026, context matters more. Price moves alone can’t cut through the fog of news noise and algorithmic trading. To get real clarity, smart analysts are layering in alternative signals on chain metrics, sentiment trackers, macroeconomic cues to get a fuller picture. It’s less about one magic signal and more about reading the whole field.

Then there’s the short vs. long term dilemma. Chasing every 4 hour candle might feel like control, but zooming out often wins. With crypto cycles stretching and compressing at weird intervals, seeing the monthly and weekly setups helps traders avoid panic and ride trends more cleanly. In other words: don’t ignore the candles, but don’t let them blind you either.

Market Sentiment: The Hidden Driver

Understanding price charts is just part of the picture. In 2026, market sentiment is moving markets faster and with more volatility than ever before. Crowd psychology, shaped by digital behavior and real time conversations, has become a vital but often overlooked signal.

Why Sentiment Matters More Now

Speed of change: Emotions fear, greed, hype spread instantly online, accelerating both rallies and crashes.

Behavioral shifts: Investors, especially retail traders, now react to narratives just as much as numbers.

Volatility trigger: Public reactions often serve as early indicators of volume spikes or sudden reversals.

Core Sentiment Signals to Watch

Learning to monitor sentiment can give you a sharper edge. Here are a few high impact indicators:

Social Media Buzz

Twitter/X, Reddit, and YouTube comments affect market direction

Look for sudden surges in mentions of specific coins or projects

News Cycles

Major headlines whether bullish or bearish can trigger momentum within hours

Context matters: understand how news is interpreted by different investor groups

On Chain Chatter

Wallet movement, gas spikes, and whale alerts fuel speculation

Community responses reveal the emotional temperature before price follows

Learn to Read the Signals

Dig into the dynamics of crypto sentiment to better recognize early pivots and opportunities. One solid resource to start with:

Market sentiment trends

Sentiment isn’t just noise it’s a signal that can help you stay ahead when interpreted correctly.

Institutional Movement = Market Gravity

Quietly but consistently, the big players whales, hedge funds, family offices are maneuvering chess pieces while everyone else is watching the scoreboard. Wallets connected to institutions show large inflows before market rallies and strategic exits before downturns. You won’t see it in headlines, but blockchain sleuths have been tracking movements that precede major price shifts by weeks.

ETF flows are another tell. When capital pours into crypto indexed ETFs or flows out rapidly, it’s not just noise it’s long view conviction or risk off retreat. These money patterns often set the tone for broader retail sentiment, even if most retail traders catch on late. That delay is the gap and it’s widenable.

Closing it starts with better tools. On chain analytics, ETF trackers, and wallet monitoring services give retail a fighting chance. But more importantly, mindset needs to shift. Don’t chase headlines follow the flows. The smart money rarely talks, but their moves speak volumes.

On Chain Analytics: Clarity in the Chaos

There’s a reason serious traders stare at address activity more than price charts now. When wallets light up, something’s coming. Active addresses, miner flows, and token velocity don’t lie and they don’t lag. These metrics give you a live pulse of a network’s health, usage, and sentiment, long before that news hits your feed.

In 2025, spikes in active addresses preceded major rallies in coins like SOL and ARB by days, not hours. Similarly, sudden miner sell offs sparked panic sell cascades before retail even reacted. The ability to spot these moves who’s accumulating, who’s dumping, and how fast capital is rotating became the edge. For investors tuned in, it wasn’t magic. It was data.

Token velocity, too, flipped into focus how often a crypto asset actually moves wallets told sharp traders whether a run had real adoption or was just hype. Slower velocity in memecoins? Warning light. Stable but rising transfers in layer 1s? Green light.

The blockchain doesn’t keep secrets. You just need to know where to look.

Regulatory Signals: Ignore Them at Your Own Risk

In crypto, policy doesn’t trickle it slams. Overnight, a new regulation in Washington or Brussels can wipe out momentum, reroute capital, and blindside unprepared investors. That’s especially true now, with global governments paying closer attention to stablecoins, central bank digital currencies (CBDCs), and crypto ETFs. Legal clarity used to take years. In 2026, it might take just one press release.

Stablecoin regulation is the first pressure point. Peg stability and underlying collateral are under the microscope. Governments want control, and any asset that looks like money without being regulated like money is catching heat. Then come CBDCs the state backed digital coins gaining real traction. Their rollout isn’t killing crypto outright, but it’s shifting the playing field. Less anonymity. More state eyes.

Meanwhile, ETF approval cycles have turned into volatility switchboards. A single approval can flood markets with institutional money. A delay? Cue retreat. Smart investors don’t just track price they monitor the regulatory calendar. They brace for swings, hedge their bets, and stay detached when others spiral.

Bottom line: global policy isn’t background noise it’s a frontline indicator. Those who treat it that way stay ahead.

Macro Clues for a New Cycle

In 2026, macroeconomic trends are no longer background noise they’re center stage. As crypto matures, it increasingly mirrors the responses of traditional markets to global events. Ignoring macro factors now risks falling behind more adaptable players.

Economic Signals That Matter

On chain data might show activity, but it’s often the broader economic backdrop that explains why that activity happens. Key macro indicators to monitor:

Interest Rates: Central banks continue to battle inflation. Rate hikes or cuts ripple quickly through both crypto and equity markets.

Inflation Data: Higher inflation often renews interest in crypto as a hedge, especially Bitcoin. Conversely, cooling inflation can shift investment back toward traditional assets.

Tech Sector Trends: The performance of major tech firms gives clues about risk appetite. As many crypto investors also hold tech stocks, shifts in this space inform sentiment across both markets.

Cross Market Correlations

Crypto no longer exists in a vacuum. In many cases, it now mirrors movements in:

Stock Indices: Bitcoin often trades in sync with the Nasdaq and S&P 500, especially during risk on or risk off market cycles.

Commodity Prices: Gold, oil, and even industrial metals can act as indicators of macro sentiment. A spike in gold can indicate a defensive market posture often mirrored in crypto leadership.

Why Macro Matters More Than Ever

In 2026, macro trends serve not just as context but as catalysts. Events like central bank rate decisions, inflation reports, or tech earnings can create volatility or opportunity in crypto markets overnight.

More than ever, successful crypto investors are:

Reading economic calendars, not just price charts

Tracking central bank commentary and economic indicators

Diversifying strategy across both digital and traditional asset responses

The takeaway: Macro isn’t optional anymore it’s foundational. Stay tuned in or risk tuning out of the next major move.

Final Signals: Intuition Meets Indicators

At some point, you have to stop staring at charts and start seeing patterns. The best investors in 2026 aren’t drowning in metrics. They’re spotting behavioral echoes, reading sentiment shifts before they become headlines, and knowing when to act fast or hold back.

It’s not magic. It’s merging strategy with instinct. Pattern recognition backed by data, but sharpened with experience. You still check wallet flows and candlesticks, sure. But it’s your gut refined by reps that tells you when a move feels right.

To make calls with more clarity, lean into market sentiment. Not just newsfeeds, but deeper reads: social volume spikes, influencer pivots, crowd mood swings. That’s often where the sharpest edges live. For a practical jumpstart, explore market sentiment trends. It’s part art, part science and essential for staying ahead.