As someone deeply immersed in the world of cryptocurrency, I’ve always been fascinated by the dynamic interplay between Bitcoin and alternative coins, known as altcoins. In this article, I’ll delve into a comparative market performance analysis of these two key players in the digital currency realm.

Bitcoin, the pioneer of cryptocurrencies, has long been the dominant force in the market. However, with the rise of altcoins offering innovative features and functionalities, the landscape is evolving rapidly. From Ethereum to Ripple, each altcoin brings a unique value proposition to the table, challenging Bitcoin’s supremacy.

Join me as I explore the intriguing market dynamics, price fluctuations, and investor sentiments surrounding Bitcoin and altcoins. By analyzing their performance trends, we can gain valuable insights into the future of cryptocurrency investments.

Evaluating Historical Performance

As someone deeply intrigued by the interplay between Bitcoin and alternative coins (altcoins) in the cryptocurrency realm, I delve into analyzing their historical performance to gain profound insights into their market dynamics, price movements, and investor sentiments.

Bitcoin Market Trends

Exploring the historical data of Bitcoin unveils a compelling narrative of resilience and dominance in the cryptocurrency space. With a track record dating back to its inception in 2009, Bitcoin has weathered market volatility, regulatory challenges, and technological advancements.

Its scarcity, mining difficulty adjustments, and halving events have contributed to its value proposition as a store of value and a medium of exchange.

Altcoins Market Trends

In contrast to Bitcoin’s established status, altcoins have carved out their niche in the decentralized finance landscape by offering innovative features and functionalities. Altcoins like Ethereum, Ripple, and Litecoin have surged in popularity, driven by unique use cases such as smart contracts, cross-border payments, and faster transaction speeds.

The market trends indicate a diversification of investor portfolios into altcoins, reflecting a growing interest in exploring alternative investment opportunities beyond Bitcoin.

Factors Influencing Market Performance

- Key Factors Influencing Market Performance: Several critical factors significantly impact the trajectories of Bitcoin and altcoins, highlighting the complexity of the cryptocurrency market.

-

Importance of Understanding Influences: Grasping these influences is essential for making informed decisions in the ever-evolving cryptocurrency space.

Regulatory Environment

Regulatory developments have a substantial impact on the market performance of both Bitcoin and altcoins. Regulations can legitimize cryptocurrencies as a viable asset class, attracting more institutional investors and increasing market liquidity.

Conversely, if regulations impose restrictions or uncertainty, it can lead to price volatility and dampened investment sentiment. For instance, regulatory clarity in major economies like the United States or China often coincides with price rallies, highlighting the importance of regulatory factors in shaping market movements.

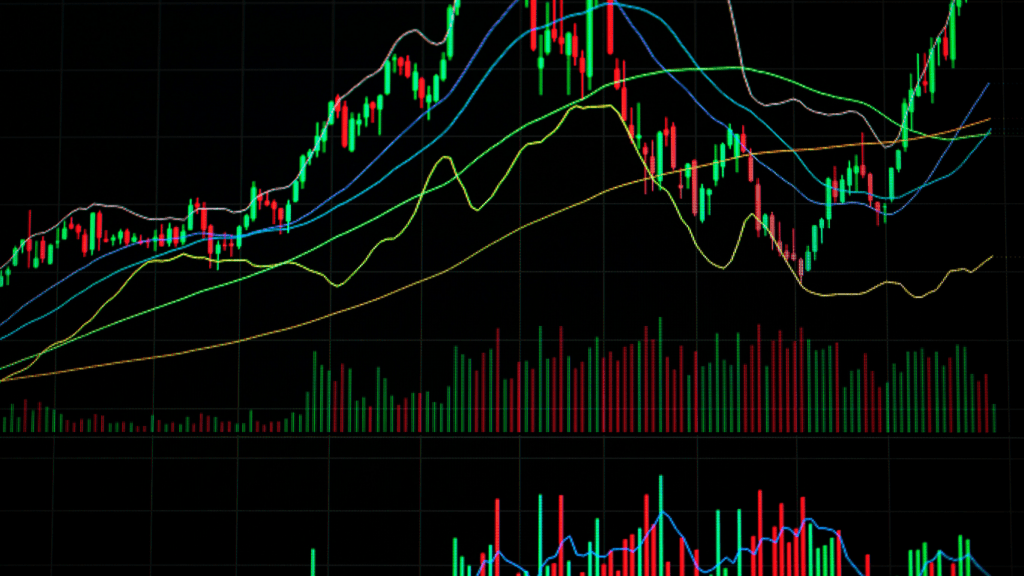

Comparative Analysis of Volatility

Analyzing the volatility of Bitcoin and altcoins is crucial in understanding their market performance. Bitcoin, as the pioneer cryptocurrency, has exhibited both high volatility and resilience over the years. Its price fluctuations are often influenced by macroeconomic factors, regulatory news, and investor sentiment.

For example, during times of economic uncertainty, Bitcoin’s price may experience significant swings as investors seek alternative stores of value. On the other hand, altcoins, such as Ethereum and Ripple, have shown even higher volatility compared to Bitcoin.

The prices of altcoins can be heavily influenced by developments specific to each project, technological upgrades, partnerships, or even social media trends. This higher volatility can present both opportunities and risks for investors looking to diversify their cryptocurrency portfolios beyond Bitcoin.

Understanding the volatility of these assets is essential for investors to make informed decisions regarding risk management and portfolio allocation. While Bitcoin’s price stability and long-term growth potential appeal to conservative investors, the higher volatility of altcoins may attract those seeking higher returns but are willing to accept greater risk.

The comparative analysis of volatility between Bitcoin and altcoins underscores the importance of considering risk tolerance, investment horizon, and market dynamics when navigating the cryptocurrency landscape. By staying informed about the factors driving volatility in the market, investors can better position themselves to capitalize on opportunities and mitigate potential risks associated with digital asset investments.

Outlook for Future Performance

Macroeconomic factors and geopolitical events will also shape the performance of digital assets. Economic trends and global uncertainties can influence valuations, so investors must stay informed to assess risks and opportunities accurately.

The future of Bitcoin and altcoins is marked by the interplay of regulatory, technological, and macroeconomic factors. By monitoring these variables, investors can strategically navigate the evolving cryptocurrency landscape and make informed investment decisions.