Curious about maximizing your cryptocurrency holdings? In the world of digital assets, crypto lending has emerged as a lucrative opportunity to earn passive income on your investments. As a seasoned crypto enthusiast, I’ve delved into the realm of earning interest on my cryptocurrency holdings through innovative lending platforms.

Navigating the complexities of crypto lending can seem daunting at first, but with the right knowledge and strategies, you can leverage your digital assets to generate substantial returns. In this article, I’ll share insights on how you can participate in crypto lending, earn interest on your crypto holdings, and make the most of this evolving financial landscape.

Understanding Crypto Lending

Exploring the realm of crypto lending opens up diverse avenues for earning interest on your cryptocurrency holdings. As an avid participant in the crypto space, delving into the intricacies of crypto lending can enhance the profitability of your digital assets.

My goal is to shed light on the mechanics of crypto lending and empower you to leverage this innovative financial tool effectively. Let’s dive into the fundamentals of crypto lending and uncover the potential it holds for optimizing your crypto investment strategy.

Benefits of Earning Interest on Cryptocurrency Holdings

Exploring the potential benefits of earning interest on cryptocurrency holdings can provide valuable opportunities for maximizing returns in the ever-evolving digital asset landscape. As an avid participant in crypto lending, I’ve identified key advantages that come with leveraging your digital assets to generate passive income through interest accrual.

- Passive Income Generation: Earning interest on cryptocurrency holdings allows me to passively grow my wealth without the need for active trading or constant monitoring. By simply holding my digital assets in a lending platform, I can sit back and watch my holdings generate returns over time.

- Diversification of Investment Portfolio: By engaging in crypto lending to earn interest, I diversify my investment portfolio beyond traditional assets like stocks and bonds. This diversification helps spread risk and exposure across different asset classes, potentially leading to more stable returns.

- Hedging Against Market Volatility: Cryptocurrency markets are known for their volatility, but by earning interest on my holdings, I can hedge against price fluctuations. Even if the market experiences downturns, the interest earned provides a buffer against potential losses.

- Compound Interest Growth: Leveraging crypto lending for interest allows me to benefit from compounding returns. As interest accrues on my initial investment, it generates additional income, leading to exponential growth of my cryptocurrency holdings over time.

- Liquidity and Flexibility: Participating in crypto lending for interest provides me with liquidity options. I can choose to reinvest the earned interest, withdraw it for other investments, or simply hold it as additional income, offering flexibility in managing my financial resources.

By capitalizing on the benefits of earning interest on cryptocurrency holdings through crypto lending, I enhance the profitability of my digital assets and optimize my overall investment strategy in the dynamic realm of cryptocurrencies.

How Crypto Lending Platforms Work

Cryptocurrency lending platforms operate as intermediaries connecting borrowers seeking funds with lenders looking to earn interest on their digital assets. By participating in crypto lending, individuals can leverage their cryptocurrency holdings to generate passive income through interest payments.

Opening an Account

To get started with a crypto lending platform, I recommend researching and selecting a reputable platform that aligns with your financial goals and risk tolerance. Signing up for an account typically involves providing basic personal information, verifying your identity, and setting up security measures like two-factor authentication to safeguard your funds.

Depositing Cryptocurrency

Once your account is set up, depositing cryptocurrency into the platform is a straightforward process. You can transfer your digital assets from your private wallet to your lending account on the platform.

It’s essential to follow the platform’s guidelines on supported cryptocurrencies, minimum deposit amounts, and deposit fees, if any, to ensure a seamless deposit experience.

Choosing a Lending Plan

When selecting a lending plan, consider factors such as the duration of the loan, the interest rate offered, and the platform’s reputation and track record. Evaluate the risk associated with each lending plan and choose one that aligns with your investment objectives.

Some platforms offer flexible lending options, allowing you to adjust your investment strategy based on market conditions and your risk appetite.

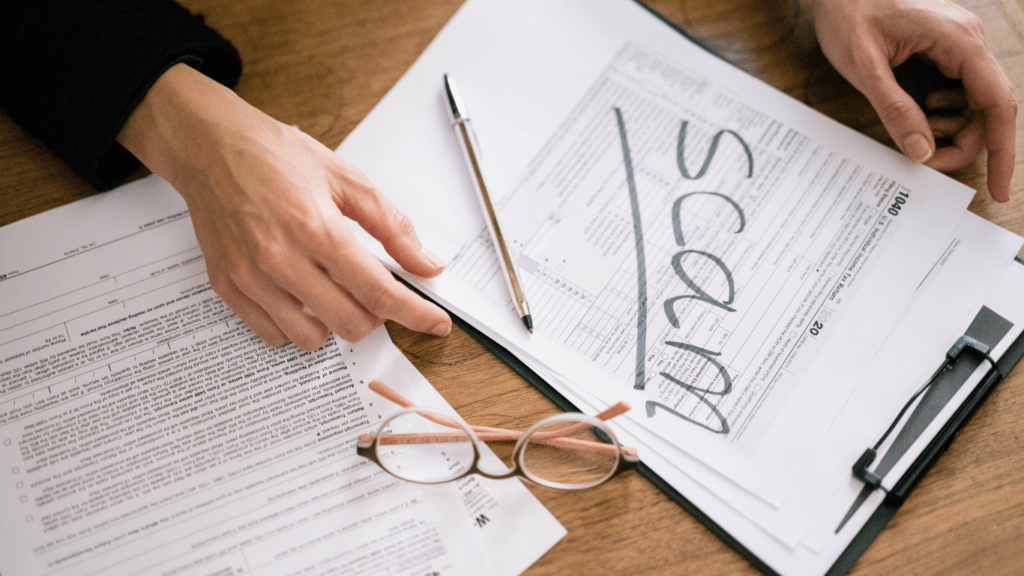

Risks and Considerations in Crypto Lending

Exploring opportunities in crypto lending is exciting, but it’s crucial to be aware of the associated risks and considerations to make informed decisions. Here are key aspects to keep in mind:

- Volatility and Market Risk: While crypto lending offers the potential for attractive returns, the cryptocurrency market is highly volatile. Fluctuations in prices can impact the value of your holdings and the interest earned.

- Counterparty Risk: Engaging in crypto lending involves counterparties – borrowers and lending platforms. There’s a risk of default by borrowers or platform failures, which can result in loss of funds.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies and crypto lending is evolving. Changes in regulations or unforeseen legal actions may affect the operation and profitability of lending platforms.

- Smart Contract Risks: Crypto lending platforms often use smart contracts to automate transactions. Vulnerabilities in smart contracts could be exploited by malicious actors, leading to financial losses.

- Liquidity Risks: Depending on market conditions, withdrawing your funds from a lending platform may not always be immediate. Illiquidity can pose challenges, especially during periods of high market activity.

- Interest Rate Fluctuations: Interest rates in crypto lending can vary based on market demand and platform policies. Sudden changes in interest rates may impact your expected earnings.

Being proactive and conducting thorough research can help mitigate these risks. Assessing your risk tolerance, diversifying your investments, and staying informed about market trends are key strategies to navigate the complexities of crypto lending successfully.

Future Trends in Crypto Lending

Exploring the future trends in the realm of crypto lending offers valuable insights into the evolving landscape of digital assets and investment opportunities. As an avid follower of cryptocurrency developments, I’ve observed several key trends that are shaping the future of crypto lending:

- Decentralized Finance (DeFi) Disruption: DeFi platforms are redefining the traditional financial system by offering decentralized lending and borrowing services. This trend is likely to continue growing, providing enhanced transparency, accessibility, and autonomy to crypto investors.

- Institutional Adoption: With established financial institutions showing increasing interest in cryptocurrencies, the integration of crypto lending services into mainstream finance is expected to expand. Institutional participation could bring greater liquidity and stability to the crypto lending market.

- Enhanced Security Measures: As the crypto lending industry matures, there is a growing emphasis on enhancing security measures to protect users’ assets and data. Innovations in blockchain technology and advanced security protocols are likely to bolster trust among investors.

- Integration with NFTs: The rising popularity of Non-Fungible Tokens (NFTs) could lead to innovative lending models that involve leveraging NFT assets as collateral. This integration could open up new avenues for borrowing and lending in the crypto space.

- Regulatory Developments: Regulatory clarity and compliance frameworks are essential for the sustainable growth of crypto lending. Continued efforts to establish clear regulations and guidelines may shape the future landscape of crypto lending platforms.

By staying informed about these emerging trends and adapting strategies accordingly, investors can position themselves to capitalize on the shifting dynamics of the crypto lending market. Embracing innovation, security, and regulatory compliance is crucial for navigating the future of crypto lending successfully.