As a seasoned cryptocurrency enthusiast, I delve into the world of technical analysis to uncover the key indicators that drive major cryptocurrencies’ market movements. Understanding these indicators is crucial for any investor looking to navigate the volatile yet rewarding landscape of digital assets.

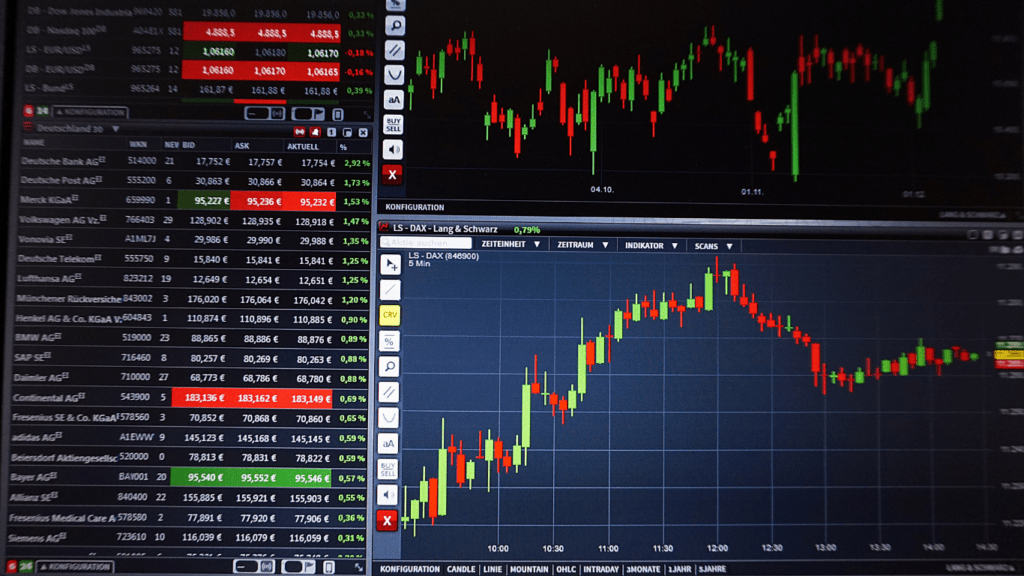

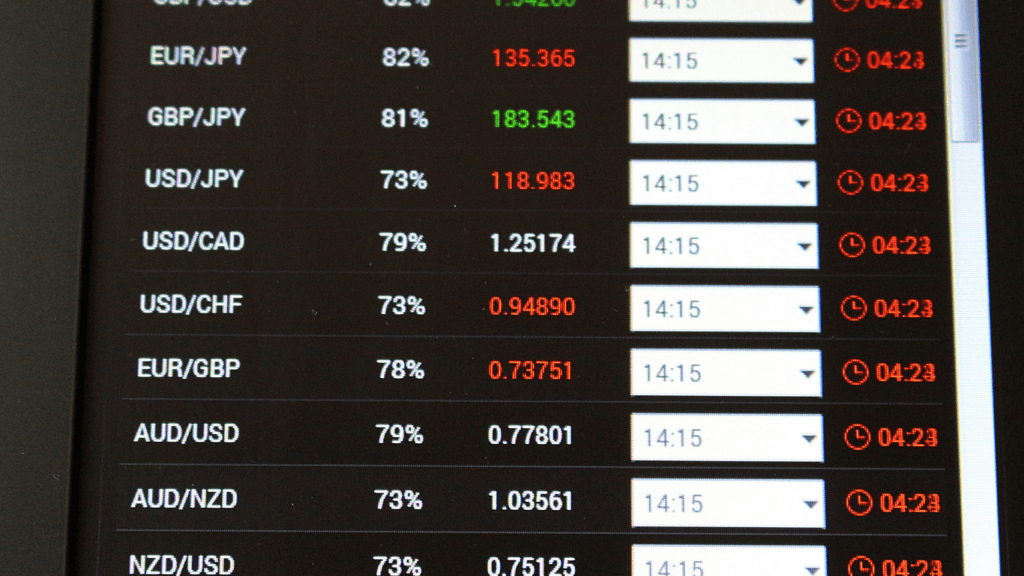

From moving averages to relative strength index (RSI), these tools offer valuable insights into price trends and potential entry or exit points. Analyzing major cryptocurrencies like Bitcoin, Ethereum, and Litecoin requires a keen eye on market sentiment, trading volume, and historical price data.

By incorporating technical analysis into your investment strategy, you can make informed decisions based on statistical probabilities rather than mere speculation. Join me on this exploration of the essential indicators that can help you gain an edge in the dynamic world of cryptocurrency trading.

Understanding Technical Analysis of Major Cryptocurrencies

- Importance of Technical Analysis: A solid understanding of technical analysis is essential for navigating the volatile cryptocurrency market, with key indicators like moving averages and the relative strength index (RSI) helping investors make informed decisions regarding major cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

-

Guiding Investment Strategies: Utilizing technical analysis provides valuable insights that guide investment strategies, allowing investors to decipher trends, identify potential entry and exit points, and optimize trading positions for improved profitability in the cryptocurrency landscape.

Key Indicators for Cryptocurrency Technical Analysis

Starting with moving averages, these indicators smooth out price data to identify trends over specific timeframes. Utilizing short-term and long-term moving averages helps me determine potential support and resistance levels, aiding in making informed trading decisions.

Moving on to the Relative Strength Index (RSI), I rely on this momentum oscillator to gauge the speed and change of price movements. By analyzing whether a cryptocurrency is overbought or oversold, I can assess potential price reversals and confirm market trends.

Exploring Fibonacci Retracement Levels, these tools help me identify potential reversal points during market corrections. Utilizing key Fibonacci ratios, I pinpoint crucial levels where prices may bounce back, enabling me to plan entry and exit strategies more effectively.

Key Cryptocurrencies for Technical Analysis

In analyzing cryptocurrencies, it’s crucial to focus on major players like Bitcoin, Ethereum, and Litecoin. These digital assets have a significant impact on the overall cryptocurrency market movements.

By examining the technical aspects of these key cryptocurrencies, investors can gain valuable insights into potential trends and make more informed trading decisions. When delving into technical analysis, Bitcoin stands out as the pioneer and powerhouse of the cryptocurrency world.

Its price movements often set the tone for the entire market, making it a critical asset to monitor. Ethereum, known for its smart contract capabilities, is another essential cryptocurrency for technical analysis. Understanding Ethereum’s price behavior can provide insights into the broader market sentiment due to its widespread use in decentralized applications.

Additionally, Litecoin, often referred to as the silver to Bitcoin’s gold, offers unique advantages for technical analysis. With faster transaction speeds and lower transaction fees compared to Bitcoin, Litecoin’s price movements can signal shifts in market dynamics.

Monitoring these key cryptocurrencies allows investors to stay abreast of market trends and potential trading opportunities in the volatile cryptocurrency landscape.