Venturing into the world of decentralized finance (DeFi) can be exhilarating, but it’s crucial to safeguard your assets against unforeseen risks. That’s where DeFi insurance comes in, offering a safety net in this innovative yet volatile landscape.

As I delve into the realm of “DeFi Insurance: Protecting Your Assets in a Decentralized World,” I’ll unravel the significance of this emerging sector and how it can shield your investments from potential threats. In this article, I’ll explore the ins and outs of DeFi insurance, shedding light on how it functions, why it’s essential, and the top platforms leading the way in this space.

By understanding the role of insurance in DeFi, you can make informed decisions to fortify your financial portfolio and navigate the decentralized realm with confidence. Join me on this journey to discover how you can secure your assets and embrace the future of decentralized finance.

Understanding DeFi Insurance

Exploring the realm of DeFi insurance opens up a new avenue for protecting assets in the evolving landscape of decentralized finance. Delving into DeFi insurance sheds light on the mechanisms that underpin asset protection strategies within decentralized platforms.

In this section, I’ll delve deeper into the nuances of DeFi insurance and its pivotal role in safeguarding assets in a decentralized ecosystem.

Importance of Asset Protection

In the decentralized world of finance, safeguarding assets is crucial to mitigate risks and ensure the security of investments. As an investor in decentralized platforms, I understand the significance of asset protection in navigating the dynamic landscape of DeFi.

By recognizing and addressing the potential risks involved, I can proactively safeguard my assets and optimize my financial strategies.

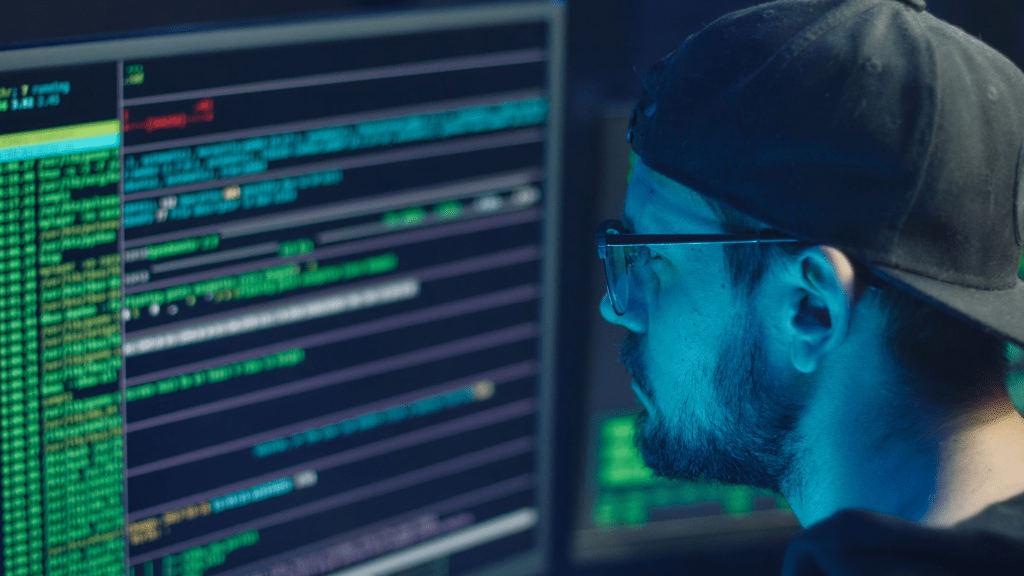

Risks in Decentralized World

In the decentralized world, risks lurk in various forms, ranging from smart contract vulnerabilities to network attacks. As an investor, I acknowledge the importance of being vigilant against these risks to prevent potential loss of assets.

Understanding the inherent risks in decentralized finance empowers me to make informed decisions and seek out robust asset protection solutions.

Popular DeFi Insurance Platforms

Exploring the landscape of DeFi insurance leads me to highlight some of the most popular platforms offering this crucial service. These platforms play a vital role in enabling users to protect their assets in the decentralized world effectively.

- Nexus Mutual: Navigating the DeFi insurance space, one platform that stands out is Nexus Mutual. It operates as a decentralized alternative to traditional insurance, providing coverage for smart contract failures, hacks, and other vulnerabilities.

- Cover Protocol: Cover Protocol is another prominent player in the DeFi insurance sector. This platform allows users to purchase coverage against smart contract risks and exploits. By leveraging a peer-to-peer coverage model, Cover Protocol offers flexibility and transparency in safeguarding assets within the decentralized realm.

- Armor: Armor simplifies DeFi insurance by offering protection against a range of risks, including smart contract hacks and oracle failures. With a focus on user experience and comprehensive coverage options, Armor aims to provide a seamless insurance solution for DeFi participants looking to mitigate potential threats to their investments.

- Unslashed Finance: Unslashed Finance introduces a unique approach to DeFi insurance by allowing users to stake capital in a collective insurance fund. This platform emphasizes shared risk mitigation and rewards participants for contributing to the overall security of the ecosystem.

- Bridge Mutual: Bridge Mutual offers decentralized coverage for various DeFi protocols, enabling users to purchase protection against hacks, exploits, and other unforeseen events. Through a community-governed platform, Bridge Mutual fosters trust and transparency, empowering users to safeguard their assets with customizable coverage options tailored to their specific needs.

Factors to Consider When Choosing DeFi Insurance

In selecting DeFi insurance, it’s crucial to evaluate specific factors that can impact the protection of your assets in the decentralized landscape.

- Coverage Options: When assessing DeFi insurance providers, consider the range of coverage options available. Ensure that the coverage aligns with your assets’ value and the potential risks you aim to mitigate.

- Claim Process: Evaluate the claim process of different DeFi insurance platforms. Look for transparent and efficient procedures that facilitate the swift resolution of claims in times of need.

- Premium Costs: Compare the premium costs across various DeFi insurance providers. Opt for a balance between cost and coverage to ensure you’re getting value for the protection offered.

- Reputation and Track Record: Research the reputation and track record of DeFi insurance platforms. Choose established providers with a history of fulfilling claims and protecting users’ assets effectively.

- Community Feedback: Consider community feedback and reviews on different DeFi insurance platforms. Insights from other users can offer valuable perspectives on the platform’s reliability and performance.

By considering these factors, you can make an informed decision when choosing DeFi insurance to safeguard your assets in the decentralized financial environment.