What Makes DeFi Lending Different

Decentralized finance (DeFi) reimagines how lending works by removing traditional banking intermediaries and enabling global access through blockchain technology. With DeFi, users control their own financial activity in a transparent and efficient ecosystem.

Key Features that Set DeFi Apart:

Permissionless Access

No need for bank approval, credit history, or third party intermediaries. Anyone with an internet connection and a crypto wallet can lend or borrow instantly.

Global Participation

DeFi opens lending markets to users around the world, particularly those without access to traditional banking. It levels the financial playing field across borders.

Smart Contract Automation

Rather than relying on paperwork and lengthy approval processes, DeFi protocols utilize smart contracts self executing code that governs loans, repayments, and interest terms. This ensures speed and removes human error.

Real Time Transparency

DeFi platforms provide live updates on interest rates and loan activity. Borrowers and lenders can view how funds move, how interest accrues, and how the protocol adjusts parameters, all on chain.

These innovations make DeFi a radically different model not just a digital overlay on existing systems, but a foundational shift in who can lend, who can borrow, and how finance operates.

Core Benefits Over Traditional Finance

DeFi lending doesn’t wait around. Loan approvals that might take days or even weeks with a bank get handled in minutes. Smart contracts automate approvals and settlements no human bottlenecks, no paperwork. The process relies on code and collateral, not credit scores or long histories.

For lenders, the upside is clear: higher yields. Instead of earning a fraction of a percent in a traditional savings account, users can lock in lending rates in the mid single digits or more depending on market conditions. It’s not risk free, but the returns are hard to ignore.

Borrowers put up crypto as collateral instead of applying for fiat based credit. That means faster access to liquidity without selling assets. They hold onto upside potential while unlocking short term value. It’s borrowing on your own terms, not the bank’s.

The best part? You call the shots. No middlemen. No managers. No gatekeeping. Just your wallet, your assets, and the protocol. DeFi puts users in control, not institutions.

Risks and Volatility: What Users Need to Know

DeFi lending isn’t without its cracks. First up: smart contracts. These bits of code run the show handling loans, interest, repayments but they’re only as good as the humans who wrote them. One bug, and suddenly funds can be frozen or drained. Exploits happen, often fast, and with major consequences.

Next is over collateralization, the DeFi world’s version of playing it safe. To borrow $100, you might need to lock up $150 or more in crypto. It keeps the system solvent but it also puts borrowers at risk. If the value of your collateral drops, your assets can get liquidated without much warning. Fast moving markets make this a real concern.

Speaking of volatility: crypto prices don’t sit still. You might lock in a loan when your assets are worth something but see them tank overnight. That directly hits both borrower risk and lender confidence. Unlike fiat systems, there’s usually no safety net.

Then there’s regulation or lack of it. Governments are still catching up, and policies shift by the month. Some regions accept DeFi as inevitable, others are threatening bans or harsh compliance rules. This is the wild frontier of finance, and the uncertainty adds friction for adoption and growth.

DeFi offers freedom, but users need to understand the stakes. It’s not plug and play banking. It’s a system that rewards vigilance and punishes assumptions.

Real World Use and Growing Adoption

DeFi isn’t just a buzzword anymore it’s going up against some of the biggest names in financial tech, and holding its ground. Platforms like Aave, Compound, and Maker are processing volumes that rival legacy FinTech lenders. And with leaner infrastructure, they’re doing it without the overhead and often without the bias.

Institutional players are watching. In fact, some are starting to dip their toes in. Investment firms, hedge funds, and even banks are testing DeFi protocols, setting up smart contracts, and exploring liquidity pools. But they’re moving slow. Trust has to be earned. And for now, institutions are more likely to experiment through custodial DeFi or hybrid models ways to gain exposure without going full crypto native.

The impact is arguably most visible in places where traditional banking falls flat. Across parts of Africa, Southeast Asia, and Latin America, DeFi is acting as an alternative to banks that either don’t exist or don’t serve everyone. People are using crypto backed loans to fund businesses, manage cash flow, or hedge against currency instability. It’s not hype it’s necessity.

Explore more in depth examples and data here: DeFi Lending Impact.

The Bigger Picture: Systems in Transition

DeFi didn’t break banking but it did shake it hard enough to demand a response. Traditional financial institutions no longer get to set the pace. Decentralized lending offers speed, access, and self custody, and banks know they can’t compete with 24/7 borderless finance using outdated systems. That kind of pressure forces innovation, and fast.

Enter CBDCs. Central banks are now trialing or rolling out digital currencies not just to modernize payments, but to claw back relevance in a space being rapidly redrawn by DeFi. These digital currencies are structured, trackable, and tightly controlled a direct contrast to the open, permissionless world DeFi operates in. Still, they share one key trait: the shift toward programmable money.

Long term, the ripple effect touches everything. Credit scoring models might evolve away from messy, opaque reports to on chain histories. Financial privacy becomes a growing debate as programmability meets surveillance. And access? It’s expanding slowly but steadily to populations that banks have underserved for decades.

This isn’t a niche experiment anymore. It’s infrastructure in transition. For more on how the pace is quickening, explore this deep dive: DeFi Lending Impact.

Closing Insight: Why It’s Just the Beginning

DeFi Is Just Getting Started

Despite its rapid growth and public attention, decentralized finance is still in its infancy. Protocols continue to evolve, and new platforms emerge almost weekly. From innovative lending models to cross chain integrations, the space is characterized by experimentation and constant iteration.

Many key technologies are still maturing

User interfaces are becoming more intuitive, but friction remains

Infrastructure upgrades and scaling solutions are on the horizon

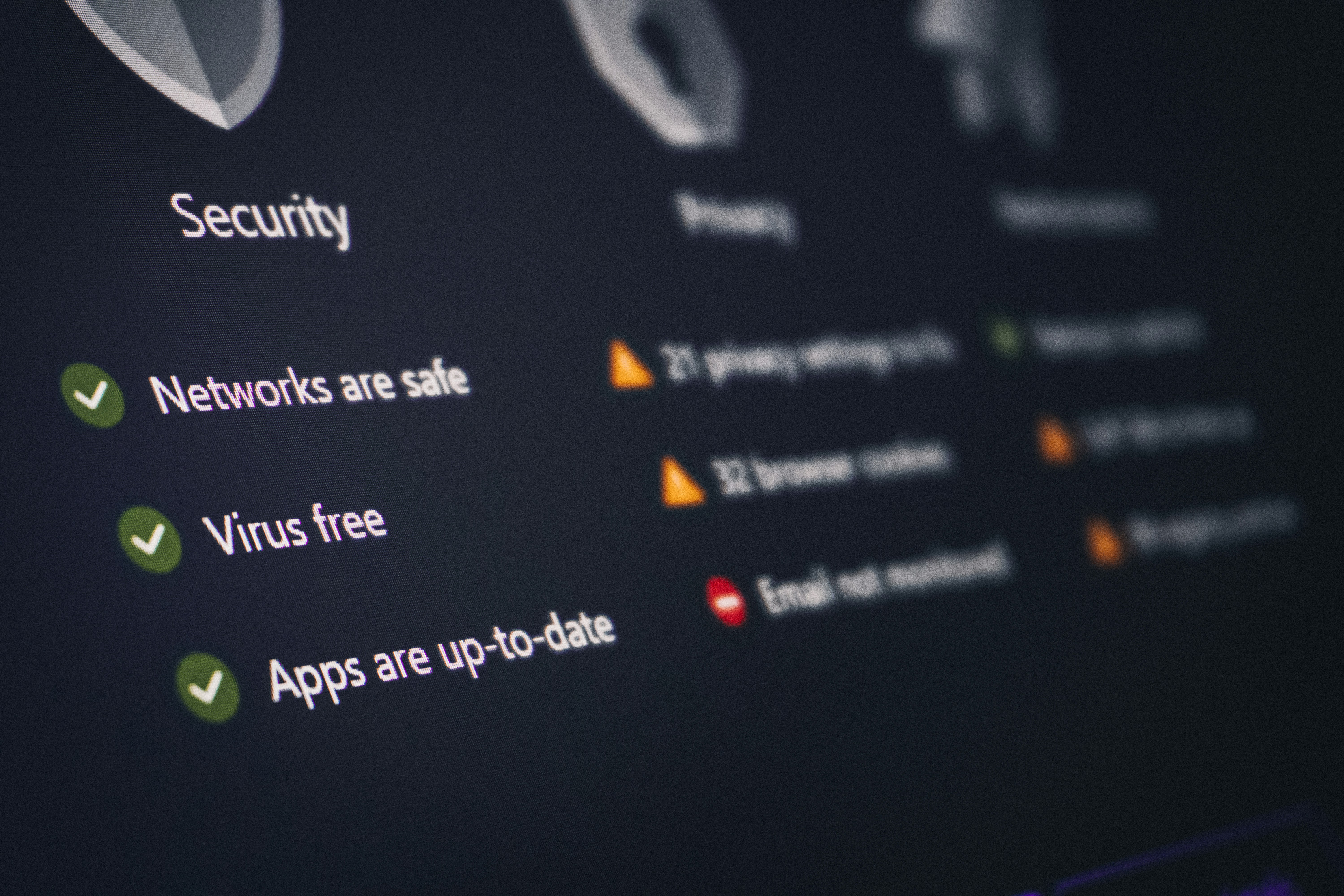

Education and Security: Pillars of Sustainable Growth

Adoption will depend heavily on how well users understand how DeFi works and how safe it truly is. In a landscape run by smart contracts rather than institutions, technical literacy and self custody become essential user responsibilities.

Clear resources and educational content are crucial for mass adoption

Security audits and bug bounties help strengthen protocol reliability

Wallet safety and phishing awareness remain top priorities

Adapt or Be Left Behind

Traditional finance faces a fundamental challenge: adapt to decentralized models or risk obsolescence. As users demand more control, transparency, and yield, the momentum behind DeFi will keep building. Whether through integration or competition, legacy institutions must now reconsider how they serve their customers in a transformed financial environment.

Financial institutions must innovate or lose relevance

DeFi will likely shape new industry standards

The coming years will define winners through adaptation and trust

The takeaway? DeFi’s first wave was a proof of concept. What comes next will define the future of finance.